Estimate your salary sacrifice savings

Bundle your car expenses into one simple payment – all from your pre-tax salary.

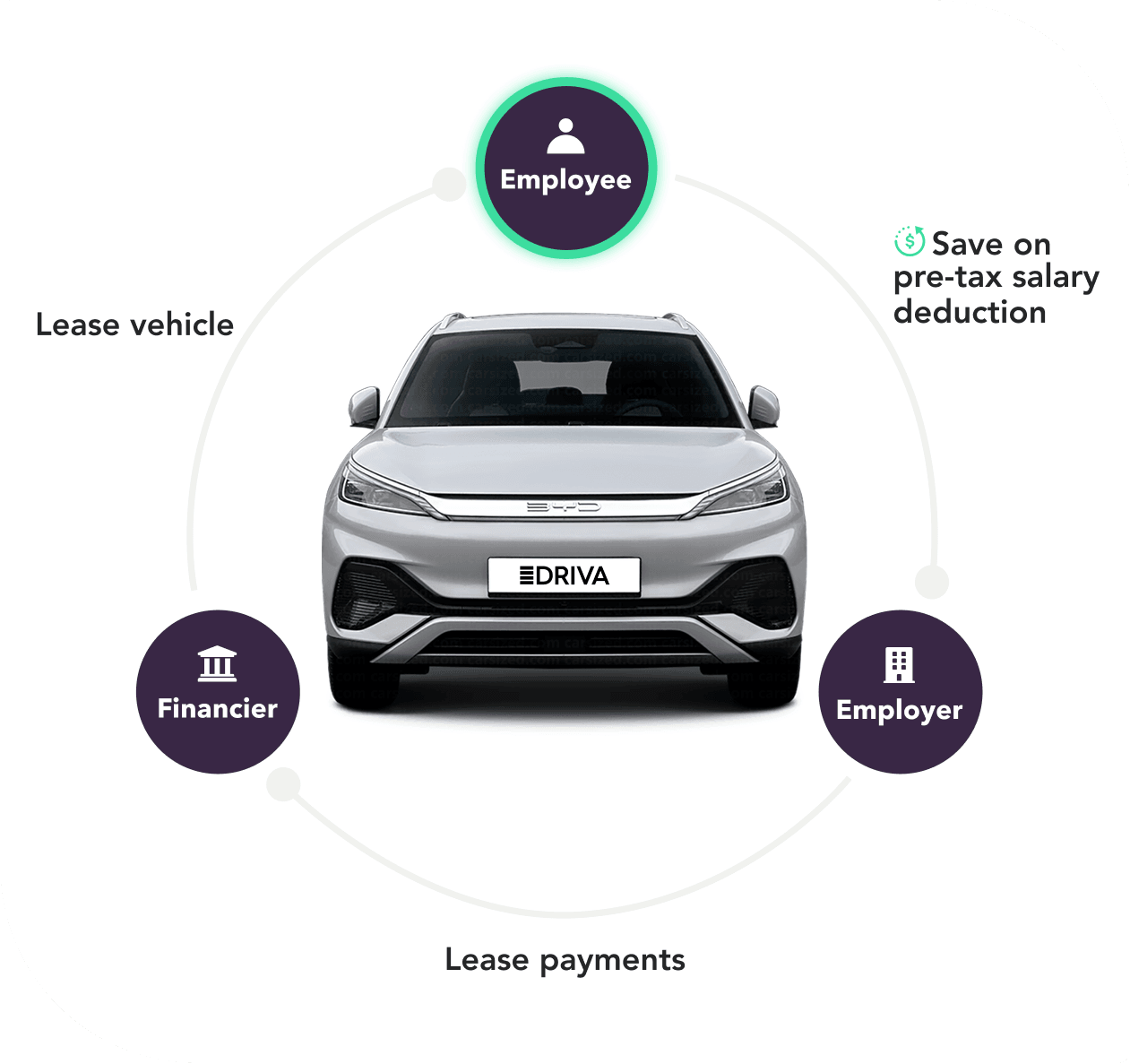

How does a salary sacrifice work?

A salary sacrifice car scheme is a beneficial arrangement between an employee and their employer that allows the employee to drive a car of their choice, whether it’s an electric vehicle, plug-in hybrid, or a traditional petrol car, by sacrificing a portion of their gross salary.

The key advantage of salary sacrifice is that payments for the car are deducted directly from your pre-tax salary. This can reduce your income tax and National Insurance contributions, while giving you access to a fully maintained vehicle. All running costs, including servicing, tyres, insurance and roadside assistance can be bundled into one fixed monthly amount, making budgeting simple and predictable.

Establish a scheme

Provide the Driva team with a few key details about your company. Our team will then reach out to obtain approval and help establish a salary sacrifice scheme.

Apply online

Once the scheme is established, you’ll be able to generate an accurate quote and see the impact on your take-home pay directly in your Driver Portal.

Fast approval

We assess your application and secure the best possible price by comparing lease options across our panel of lenders and vehicles across our network of dealerships, before submitting it for approval with your employer.

Employer approved

Once the employer approves the lease, we assist in the payroll set up to allow the lease payments to come out automatically pre-tax. We organise the settlement of funds with the dealership and pick up/delivery of the vehicle.

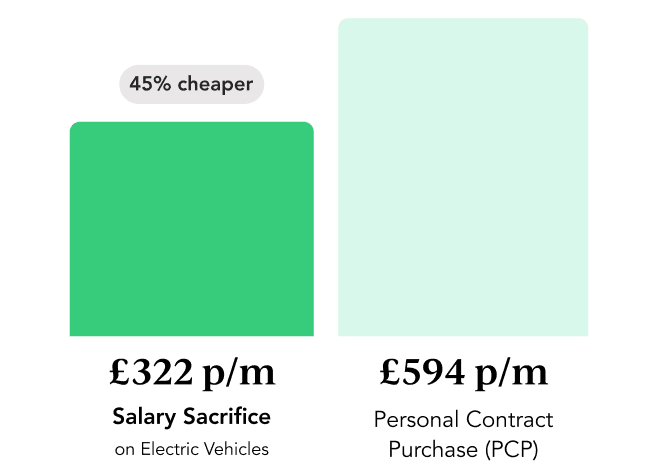

Can make driving an EV 30–45% more affordable*

Salary sacrifice can make driving up to 45% cheaper than traditional car finance options such as PCP, Hire Purchase or PCH. Not only do you benefit from payments being deducted pre-tax, but both you and your employer save on National Insurance contributions.

With current government incentives for EVs, Benefit-in-Kind (BIK) tax is only 3%, making electric vehicles significantly more affordable.

*Savings calculated from reduced income tax and NIC. Includes all interest and lease costs. Based on a £100,000 salary, 4-year lease, £50,000 vehicle, no downpayment, 7% interest, and a 50% residual.

Save more with Salary Sacrifice

With salary sacrifice, you can bundle your rental repayments and running costs, such as insurance and maintenance into a single payment taken from your pre-tax salary.

By reducing your taxable income, you pay less tax and increase your take-home pay without compromising on your vehicle choice. Plus, there are no upfront costs, making it easier to get into a car sooner.

Pay limited BIK on EVs

If you choose an eligible electric vehicle (EV), you benefit from the generous Benefit-in-Kind (BIK) discounts introduced by the UK Government.

This means you can typically lease an EV with only a 3% BIK rate, saving you thousands compared with a traditional vehicle. It’s an ideal option for eco-conscious drivers looking for a smart, cost-effective way to go green without the premium price tag.

Customised leasing that fits you

No two drivers are the same, and your salary sacrifice lease should reflect that. With Driva, you can customise your lease to suit your lifestyle, budget, and driving habits.

Choose your preferred vehicle, set your lease term, and personalise your inclusions. Whether you’re looking for a practical daily driver or a premium upgrade, Driva gives you full control of your lease.

Don’t take our word for it

We always recommend a second opinion. Read our customer reviews.